dependent care fsa rules 2021

Employers can choose whether to adopt the increase or not. Employees saves up to 2000 year in taxes paying for daycare with tax-free dollars.

Your employer may elect a lower contribution limit.

. The limit will return to 5000 for 2022. Filers could claim up to. You can use your dependent care FSA to pay for qualified expenses through your dependent childs 14 th birthday.

Generally you can only use DCAP for children age 0-12 years not yet reached their 13 th birthday. Employees can elect up to the full 2750 limit under the health FSA or 5000 limit under the dependent care FSA for the 2021 plan year even if they are carrying over amounts from the 2020 plan year. This was part of the American Rescue Plan.

With a Dependent Care FSA you use pre-tax dollars to pay qualified out-of-pocket dependent care expenses. Thanks to the American Rescue Plan Act single and joint filers could contribute up to 10500 into a dependent care FSA in 2021 and married couples filing separately could contribute 5250. The Taxpayer Certainty and Disaster Tax Relief Act.

For married couples filing joint tax. If you have a dependent care FSA pay special attention to the limit change. Unused health and dependent care FSA funds are forfeited at the end of the plan year known as the.

Prior guidance provided flexibility to employers with cafeteria plans through the end of calendar year 2020 during which employers could permit employees to apply unused health FSA amounts and dependent care assistance program amounts to pay for or reimburse medical care or dependent care expenses. The Consolidated Appropriations Act of 2021 allows some Dependent Care FSA plan participants to file claims for their eligible dependent care expenses for children through the end of the plan year in which the child turns 13 rather than the standard. May 11 2021 Brian Gilmore Compliance Share Share on linkedin Share on facebook Share on twitter Share on email Executive Summary The IRS has issued guidance clarifying certain aspects of the American Rescue Plan Act of 2021ARPA 2021 dependent care FSA limit increase and the annual HSA limit increases for 2022.

3 Any unused amounts from your 2020 Child Care Dependent Care FSA will automatically be carried over into 2021 and may be used to pay or reimburse eligible dependent care expenses that are incurred in 2021. If you carry over any balance from 2020 to 2021 the age 14 rule applies to that money as well. If you are divorced only the custodial parent may use a dependent-care FSA.

Dependent Care FSA Eligible Expenses Care for your child who is under age 13. The limit is expected to go back to 5000. Prior to the American Rescue Plan Act of 2021 the Dependent Care Tax Credit provided a maximum of 35 of eligible childcare expenses paid during the year as a tax credit.

From the uniform coverage rule that makes the feature viable for the health FSA by aligning it with the existing dependent care FSA rules. PA Group administers our FSA plan including reimbursements. For 2021 the dependent care FSA limit dramatically increased from 5000 to 10500 because of the American Rescue Plan Act of 2021 and that change has not been extended to 2022.

Flexible Mid Year Elections. The law increased 2021 dependent-care FSA limits to 10500 from 5000 offering a higher tax break on top of existing rules allowing more time to spend the money. ARPA allows employers to increase the annual limit on contributions to dependent care FSAs up to 10500 for the 2021 plan year only.

Double check your employers policies. The carryover option expires on December 31 2021. For 2022 and beyond the limit will revert to 5000.

For Dependent Care FSAs you may contribute up to 5000 per year if you are married and filing a joint return or if you are a single parent. Typically if you dont spend your Dependent Care FSA funds by the end of the year you lose that money. If you are married and filing separately you may contribute up to 2500 per year per parent.

Thanks to the American Rescue Plan Act single and joint filers could contribute up to 10500 into a dependent care FSA in 2021 and married couples filing separately could contribute 5250 up from 2500. Dependent care FSA increase to 10500 annual limit for 2021 June 17 2021 On March 11 2021 The American Rescue Plan Act of 2021 ARPA was signed into law by President Biden. The money you contribute to a Dependent Care FSA is not subject to payroll taxes so you end up paying less in taxes and taking home more of your paycheck.

Ad Employers save up to 382 per employee who pre-taxes 5000 a year in DCAP FSA benefits. The most money in 2021 you can stash inside of a dependent-care FSA is 10500. Meanwhile the limit on contributions to dependent-care FSAs was expanded for 2021 through a separate piece of legislation that was signed into law in March.

February 11 2021 2021-R-0054 Issue Explain federal rules that apply to health and dependent care flexible spending accounts also called arrangements including the use it or lose it rule and summarize any relief from the rules. In 2021 the Dependent Care FSA limit was increased to 10500 for single taxpayers and married couples filing jointly and to 5250 for married individuals filing separately. Health Care Flexible Spending Accounts HCFSA Public Law 116-136 the Coronavirus Aid Relief and Economic Security CARES Act includes two significant changes that affect participants with a Flexible Spending Account FSA Health Savings Account HSA or Health Reimbursement Account HRA and apply to expense amounts incurred after.

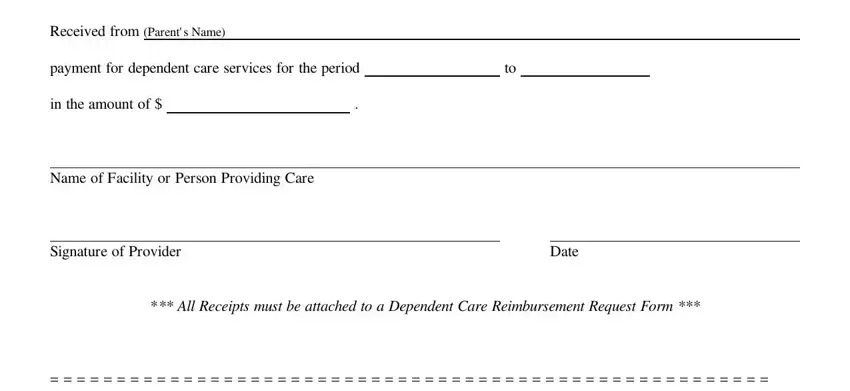

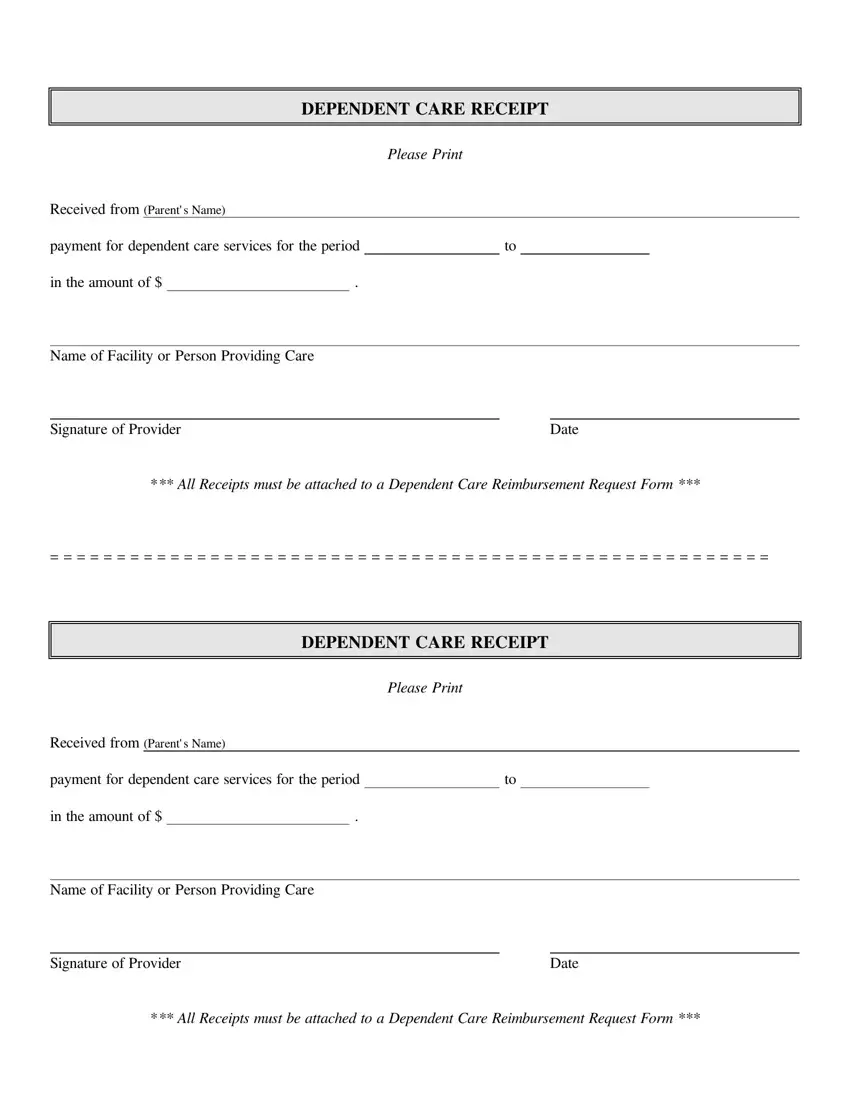

Dependent Care Receipt Fill Out Printable Pdf Forms Online

Child And Dependent Care Expenses Credit Youtube

Eligible Dependent Care Expenses Southern Adminstrators And Benefits Consultants

Dependent Care Flexible Spending Account Dcfsa From Payflex Employer Child Dependent Care Benefits

Dependent Care Flexible Spending Account Dcfsa From Payflex Employer Child Dependent Care Benefits

Healthcare And Childcare Fsa Fix For 2021 Finally Special Carry Over Rules And More

Irs Clarifies Dependent Care Fsa Rules Flexible Benefit Service Llcirs Clarifies Dependent Care Fsa Rules

Flexible Spending Account Fsa Faqs Expenses Limits Plans More

Dependent Care Receipt Fill Out Printable Pdf Forms Online

Flexible Spending Account Fsa Faqs Expenses Limits Plans More

2021 Irs Rules Allow For One Time Changes To Child Care Dependent Care Fsas San Francisco Health Service System

Dependent Care Flexible Spending Account Dcfsa From Payflex Employer Child Dependent Care Benefits

Your Dependent Care Fsa Babysitter Hiring Options Bri Benefit Resource

Dependent Care Flexible Spending Account Dcfsa From Payflex Employer Child Dependent Care Benefits